Monday, 1 December 2014

The Failure of George Osborne's 'Economic Plan'

The Tories say the economy is recovering, and they point to GDP growth statistics of 1.7% last year and a forecast of 2.7% for 2014. Labour, however, say that this doesn't matter, because the cost of living is still high and on the up. At first glance, this might seem absurd - how can a growing economy not lead to increased living standards? The reason is actually quite simple.

By making significant real-terms public spending cuts, Osborne has stifled inflow of money from the Treasury into the wider economy. Keynesian economic theory holds that governments should use public spending to stimulate demand in times of recession, but Thatcher threw Keynes out of the window back in 1979 and Osborne has ramped up the neoliberal experimentation to the point where even Maggie would be disgusted.

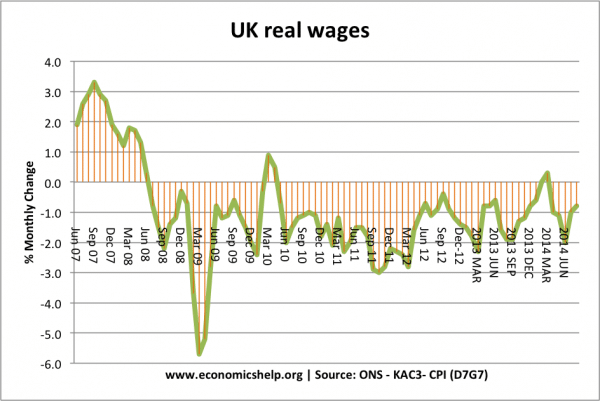

Lack of economic stimulus. has contributed heavily to wage repression - as this graph shows, wages have increased at below the rate of inflation in every quarter since the coalition came to power bar one. It is interesting to note that the brief pre-election recovery in real wages came only after two years of fiscal stimulus packages by the Brown ministry. His chosen method of stimulus, relying heavily on quantitative easing and the bank bailouts, was far from optimal - it injected money into the finance industry but neglected other sectors - but it did actually start to show some results by early 2010. Naturally, the Tories took swift steps to shut that nonsense down immediately upon assuming power.

With average wages so far below inflation, it is easy to see why most people just aren't feeling the so-called 'recovery'. Abstract GDP growth figures, however promising on paper, just don't mean anything to ordinary people if the money in their pocket isn't there. But if the economy is growing, and yet it isn't making its way down to us, then where the hell is it?!

That's an easy one too. It's in the pockets of CEOs and bankers, of company shareholders and major landowners. The combined wealth of the richest 1,000 UK households jumped 15% in 2013 and now stands at almost £520 billion, with the result that the UK now has more billionaires per head than any other country. The baseline for entry into this super-elite group is now £85 million - £5 million more than before the recession. So, while the UK as a whole has only just surpassed 2008 levels and the average person is still some considerable distance from that, the richest members of our society are actually much better off than they were six years ago.

Some people, then, have done very well out of the global economic crash and the suffering of millions. The rest of us, meanwhile, are a little more strapped for cash - and it doesn't look like it's getting any better anytime soon. With the Tories plotting a law which will make eliminating the budget deficit by 2018 a legal requirement, more cuts are on their way, which will lead to further wage depression and thus falling demand in the economy. The current trend towards underemployment, with more and more people disappearing from unemployment stats into false self-employment or abusive zero-hours contracts, will continue and the queues outside food banks and job centres will only grow.

Of course, that will push up the welfare bill, sending Daily Mail readers frothing at the mouth and baying for blood. Then the government will be 'forced' to slash social security further, driving more and more people - particularly young people - onto the scrapheap. Welcome to the age of austerity politics. It hasn't worked so far, but the elitist, neoliberal mainstream parties aren't about to let a silly little thing like that stop them! They have the lower orders to crush.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment